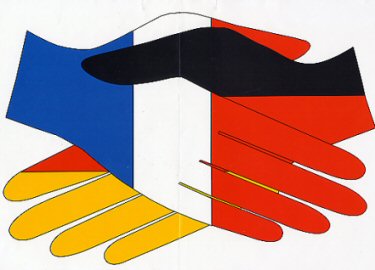

Green Book on corporate tax convergence between France and Germany

The French and German Ministries of Finance published a “Green Book” on 6 February 2012 that summarizes the current discussions on corporate tax convergence between the French and German tax systems. The Green Book outlines the current thinking on potential measures of convergence in the following areas: Group taxation, Taxation of dividends, thin capitalization, Offsetting of losses, Depreciation and amortization and Corporate income tax rates. Several measures proposed in the Green Book may be implemented by 2013.

I. Corporate income tax rates

The effective corporate tax rate levied in France is higher than in Germany.

Differences

Germany levies corporation tax at a rate of 15%, increased with a solidarity surcharge of 5.5% and a decentralized tax at a rate of 13.64%. The French corporation tax rate amounts to 33.33% increased with a 3.3% solidarity surcharge for large companies. For the years 2012 and 2013 a temporary surcharge of 5% has been proposed in France for companies with a turnover in excess of 250 mEur.

|

|

Germany |

France |

|

CIT at a centralized level |

15,825% |

34,43% – 36,1% |

|

Tax at a decentralized level |

13,65% |

8% (« CET ») |

|

« Crédit Impôt Recherche » effect and 15% rate on income (“SME”) |

– |

(5,8%) |

|

Effective corporation tax rate |

29,5% |

36,6% – 38,3% |

Convergence

The envisaged reforms would substantially broaden the tax base of French companies. For this reason, the Green Book recommends that the changes be combined with a corresponding decrease of the corporate tax rate. The amount of the decreased is not disclosed but is expected to be significant in light of the reforms contemplated.

II. Group taxation

The French grouping system of « Intégration fiscale » provides a higher minimum holding requirement than in Germany but contrary to the German system, the French tax grouping is more favourable.

Differences

There are three main differences:

|

|

France |

Germany |

|

Minimum holding requirement |

95 % |

50 % |

|

Profit and loss pooling |

Automatic (option) |

Contractual arrangement for 5 years |

|

Elimination of intra-group transactions |

Yes |

No |

Convergence

As a possible first step, the Green Paper suggested abolishing or modifying the contractual arrangement in the German rules for a profit and loss pooling, and the minimum holding requirement to create a consolidated group may be increased to 75% or even 95%.

An entire consolidated profit calculation as currently applied in France will not be introduced by Germany anytime soon because it would raise too many issues.

III. Taxation of dividends

The French and German participation exemption facility exempts 95% of qualifying participation dividends (with the remaining of the dividends being considered non-deductible costs).

Differences

France applies a minimum holding percentage of 5% (based on capital and voting) and a minimum holding period of 2 years.

Convergence

The first is the thin-capitalization rules which apply to “related companies” (the deductibility of interest paid to the latter is limited by the application of a cumulative three-step test),

The second provides that the deduction of interest expenses incurred in France by a company for purposes of the acquisition of shares qualifying for the French participation exemption regime is subject to restrictions, unless the French acquiring company can prove that the decisions relating to such shares are being taken by it and where the group exercises control (or influence) over the acquired company, such control (or influence) is exercised by the French acquiring company or one of its affiliates established in France.

The Green Book advises Germany to introduce a minimum holding percentage as is applied in France.

IV. General interest deduction restrictions

Both French and German systems have financial charges deduction rules (mainly interest expenses incurred in France or in Germany by a company for purposes of the acquisition of share) but the German rules are more restrictive.

Differences

Germany restricts the deduction of interest if the net interest expenses incurred during a book year are more than 3 mEur per company. Interest expenses exceeding 3 mEur are deductible up to 30% of the taxpayer’s taxable EBITDA. Non-deductible interest can be carried forward permanently.

France provides 2 systems:

Convergence

The abolition of the difference between dividends and interest (non-deductible dividends and non-deductible interest or deductible dividends and deductible interest) ;

The introduction of a generic earnings stripping rule in line with the German model ;

To restrict the deduction of financing costs insofar instrumental to the generation of tax exempt profits ;

To introduce specific anti-abuse measures.

The Green Book recommends France to adjust its interest deduction rules. Nevertheless, France has decided that it will first make a thorough analysis of the impact of the proposals. Any changes would subsequently be part of a general reform of its corporation tax rules, which would also incorporate a reduction in tax rates. From a French point of view, the alternatives for convergence are:

V. Loss compensation

Notwithstanding the changes enacted by the French parliament in September 2011 (limitation of the tax loss utilization as in Germany), the French tax loss compensation rules are more favourable than in Germany.

Differences

The main outstanding difference between the utilization of tax losses on France and in Germany is in the forfeiture rules, which are based on a change-of-activity in France as opposed to a change-of-ownership in Germany.

More over, the German rules provide for a loss carry-back of one year with a maximum of 511.500 € while French rules provides for a loss carry-back of one year with a maximum of 1 mEur.

Convergence

The Green Paper advises France to either adopt a system comparable to the German one (loss forfeiture in case of a change of interest), or alternatively to clarify the conditions in which a change in statutory object or nature of business is assumed.

VI. Amortization

Germany allows for the depreciation of goodwill.

Differences

The declining-balance depreciation: Germany permits a declining base depreciation and, under special conditions, France too but for certain classes of assets. The Green Book concedes that France applies this widely (declining base depreciation is allowed, among certain other things, for immovable property).

Depreciation on pooled basis: allowed in Germany with respect to certain low value assets (1.000 €) and disallowed in France ;

Depreciation of goodwill: allowed in Germany but not in France.

The main differences between France and Germany are:

Convergence

France may introduce the possibility to amortize goodwill recorded pursuant to an acquisition, but unlike the rules in Germany, this may include share purchases. Amortization on a decreasing balance basis or exceptional amortization would no longer be available to align the French tax rules with German rules.

Laurent Bibaut

Le petit juriste Site de la revue d'actualité juridique

Le petit juriste Site de la revue d'actualité juridique